Basics

Taxes, Tariffs and Fees: How Government Raises Money

Financial Services

Published on May 3, 2019

Overview

During the first two years of President Donald Trump’s administration, there have been major changes to United States tariffs and the federal tax structure. In 2017, President Trump signed the Tax Cuts and Jobs Act into law which changed United States tax brackets and ranges, impacting the U.S.’s revenue. The Trump administration also implemented new tariffs on various imports from Canada, China, and the European Union (EU). In this basic, we will explore recent changes to the United States’ taxes and tariffs and explain where the government now raises its money.

How does the government raise money?

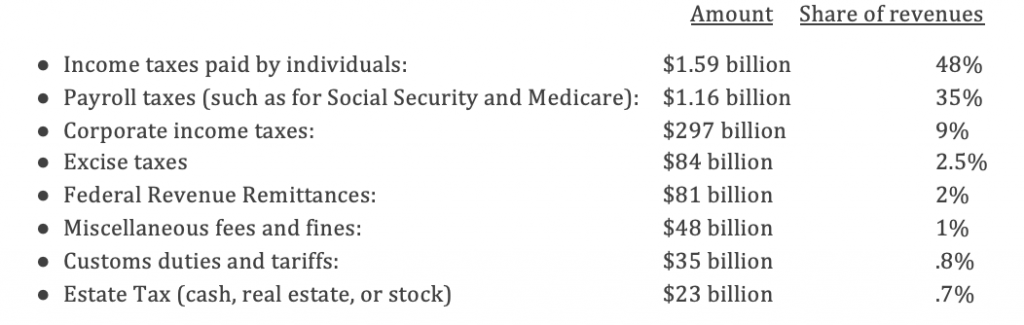

When most people think of “taxes,” individual and corporate income taxes are what come to mind. But the government raises about 10% of its revenues from other sources, including “excise” taxes on products such as alcohol, tobacco and gasoline; customs duties and taxes on imports of foreign goods (“tariffs”); estate taxes; “user” fees for government services such as issuing a patent or approving a new drug; and proceeds from the sale of federal property, rights to cut down trees or explore for oil on federally-owned land.

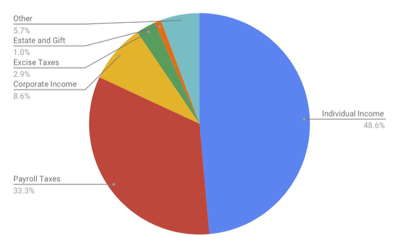

In fiscal 2017, the government raised $3.3 trillion. Here’s where it came from:

A permanent income tax was not enacted until 1913, when the 16th Amendment was ratified. Even then, individual income taxes didn’t become the biggest source of federal revenues until about 1944. Before then, excise and corporate income taxes provided the bulk of federal funds.

Does the government really need more revenues?

Government is a big part of America’s overall economic activity.

On average, government spending made up 20.8% of the nation’s annual total economic output (or gross domestic product—“GDP”) from 1968 to 2017. Government revenues, on the other hand, have fallen short of those amounts, making up just 18% of GDP on average over the same period. This “fiscal gap” between what government spends and what it raises is why we face such sizeable deficits year after year and such an astronomically high national debt today.

This gap could also worsen because: (1) government is spending more on Social Security and Medicare to support the growing number of aging Baby Boomers and because of spiraling health care costs; (2) recessions mean lower revenues because companies and people are making less money for government to tax; and (3) extending all of the Bush-era tax cuts of 2001 and 2003 could cause the government to forego as much as $3.1 trillion over the next ten years, according to the Pew Fiscal Analysis Initiative.

Tariffs

In the beginning of 2018, the Trump administration began imposing tariffs on various import items such as solar panels, washing machines, steel and aluminum from Canada, Mexico and countries in the EU. Additionally, the Trump administration placed a tariff of 25% on 818 categories of goods imported from China worth around $50 billion. As a result, China has implemented new import taxes on about $60 billion worth of American products to retaliate against the tariffs. The Trump administration argued that the changes should incentivize U.S. businesses to purchase materials from domestic manufacturers, allowing for a stronger industry and new job creation. Instead, many farmers lost sales abroad due to the trade war with China, the EU, and other states. As a result, in July 2018, the Trump administration announced that it would pay American farmers up to $12 billion through a government assistance program.

Conclusion

While income taxes and payroll taxes comprise a majority of the federal government’s revenue in the United States, excise taxes and tariffs do account for about 10% of the revenue. Additionally, the Trump Administration’s recent changes to the tax structure and the United State’s tariff war with China are also currently impacting the federal revenue. Many predict the federal deficit and fiscal gap will continue to grow amid disagreements among Republicans and Democrats about how to best allocate government resources.

Key Facts

- Total government revenues in fiscal 2017: $3.3 trillion

- Total government spending in fiscal 2017: $3.982 trillion

- Fiscal 2017 deficit: $666 billion

- Sources of federal revenues for 2017

- Individual Income Taxes: 8.3% of GDP

- Payroll Taxes: 6.1% of GDP

- Corporate Income Taxes: 1.5% of GDP

- Other: 14% of GD

- Tariffs:

- What are tariffs?

- Taxes that are paid by Americans who import goods from abroad

- New Tariffs:

- 25% on steel imports

- 10% on aluminum imports

- What are tariffs?

- Sources of 2019 federal revenues:

Links to Other Resources

- Center on Budget and Policy Priorities- Policy Basics: Where Do Federal Tax Revenues Come From?

- Congressional Budget Office – The 2018 Long-Term Budget Outlook in 25 Slides

- Congressional Budget Office – The Federal Budget in 2017

h - Internal Revenue Service – Data Book

- Peter G. Peterson Foundation – Understanding the Budget: Revenue

- The Washington Post – Trump administration slaps tariffs on roughly $200 billion more in Chinese goods — a move almost certain to trigger retaliation

- Urban Institute and Brookings Institution – Tax Policy Center – Tax Facts