Our Economy Today

America is starting to build again after emerging from the COVID-19 pandemic. The government has made big investments in infrastructure and clean energy, to strengthen the foundation of our economy. But we are facing headwinds too. Family budgets today are already squeezed by inflation, interest rate increases and the impact of geopolitical challenges.

Dig Deeper on Issues Impacting the Economy

Domestic Labor Shortage

The COVID-19 pandemic exacerbated labor shortages across the economy.

- Many workers did not return to the workforce after the COVID-19 pandemic for a variety of reasons, including early retirements, difficulty arranging child care, and concerns for their health.

- A shortage occurs when the number of job openings is greater than the number of workers filling them. As of August 2023, there were 8.8 million openings compared to 6.3 million unemployed workers.

- The COVID-19 pandemic accelerated this trend, but the issue was always on the horizon. Workers are retiring faster than new workers are joining the workforce. This creates an unsustainable trend where essential services do not have the labor to successfully serve society.

- Recent bipartisan legislation such as the CHIPS and Science Act and the Bipartisan Infrastructure Law provided funding for infrastructure investment, but a shortage of skilled labor will delay the timeline and implementation of these projects.

Labor shortages are affecting almost every industry, passing costs to consumers.

- About 1.4 million manufacturing jobs were lost during the COVID-19 pandemic.

- The construction sector is hit one of the hardest, and the costs are pretty wide-ranging, making it more expensive to build literally anything.

- The labor shortage leads to fewer contributions for Social Security, affecting retirement plans for many Americans.

- Less workers on farms create increased food prices.

- Completion of construction projects, whether they are residential homes, infrastructure initiatives, or hospitals, is restricted by a lack of available labor.

- Shortages of public transportation employees affect anyone who commutes to work, school, to run errands, get to appointments, etc.

- Without the necessary amount of workers, healthcare systems will have an increasingly difficult time providing care to those who need it most.

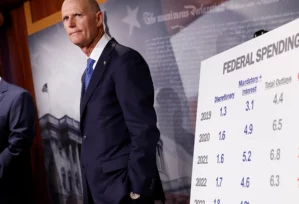

The National Debt

The U.S. has always had to deal with budgeting to avoid debt.

- Every year, the federal government earns and spends vast amounts of money. If the government spends more than it brings in, that creates a deficit. If the government operates in a deficit for years at a time, the deficits accumulate to form debt.

- The United States has carried debt since its creation, when the Founding Fathers funded the American Revolutionary War. Large increases in the debt occurred during wars, recessions, and pandemics.

- Increased spending provides for programs such as Social Security, Medicare and Medicaid, unemployment and disability benefits, and the national defense.

- Like any other type of debt, the national debt gathers interest, and as the debt grows, so does the amount of interest.

The national debt is an abstract concept that affects every American.

- Current and future generations will have to manage the debt.

- The national debt is over $33.55 trillion dollars, which is over $100,000 of debt per American.

- High deficits and debt can lead to persistent high inflation, raising costs on everyday goods and services.

- Rising interest rates affect the ability of hard working Americans to get loans or take out mortgages.

- As the interest on the debt rises, the government may have to make choices about which programs to fund, potentially reducing Social Security payments and other benefits.

- Taxes could increase to raise revenue and offset spending.

- Increased government borrowing could crowd out other types of investments in small businesses, infrastructure, and manufacturing.

Why is there a labor shortage?

A labor shortage is a critical issue that has had far-reaching effects on everyday Americans, magnified by the challenges brought about by the COVID-19 pandemic, which led to widespread layoffs in some sectors while also causing a reevaluation of work-life priorities for many individuals. The pandemic had a significant impact, but the problem was looming even before.

The U.S. was already on the precipice of a labor shortage due to a combination of factors. An aging population is gradually retiring, removing labor from the workforce without the amount of new talent to replace them. Furthermore, the skills required in today’s job market are evolving rapidly, and some workers may not possess the necessary qualifications, leading to a mismatch between available jobs and the workforce. In the next decade, it is possible industries will not have enough workers to meet the demand for their services.

The industries hit the hardest include manufacturing, leisure and hospitality industries, and food service. Shortages have broad implications; they lead to reduced contributions to Social Security, impacting retirement plans, and raise the prices of goods and services as industries struggle to find workers.

Additional Labor Shortage Resources

What makes up the national debt?

The national debt is a financial burden that holds significant implications for everyday Americans. Each year, the federal government earns and spends substantial amounts of money, and when expenditures exceed revenues, a deficit is created. Over time, these deficits accumulate to form the national debt. There are two major categories of federal debt: debt held by the public and intragovernmental holdings. Debt held by the public is any debt not attributed to the federal government. This means debt held by individuals, businesses, and state and local governments is considered to be held by the public. Intragovernmental debt is the debt the federal government and its agencies hold.

Increased spending provides for programs such as Social Security, Medicare and Medicaid, unemployment and disability benefits, and the national defense. When the government borrows money to support these programs, that debt gets added to the national debt. As the debt continues to grow, so does the amount of interest the government must pay.

Government spending helps support many Americans, but budget deficits have resulted in a national debt affecting all corners of the economy. Managing the national debt is a task that transcends generations, requiring pragmatic fiscal policy to safeguard the financial well-being of the American people.