Read about the breadth of opposition

to Basel III Endgame

Our Economy Today

America is starting to build again after emerging from the COVID-19 pandemic. The government has made big investments in infrastructure and clean energy, to strengthen the foundation of our economy. But we are facing headwinds too. Family budgets today are already squeezed by inflation, interest rate increases and the impact of geopolitical challenges.

Dig Deeper on Issues Impacting the Economy

The Fed’s Proposal and its Unintended Consequences

In July of 2023, the Federal Reserve proposed rules that could set us back by making financial markets more costly and, ultimately, hurt Americans. Families, businesses and nonprofits all rely on financial markets to finance their efforts to build for the future. Higher financing costs mean our economy recovers more slowly – leaving more families struggling and facing higher bills. The new Federal Reserve rules will add to higher costs, hurt hard-working Americans and harm American competitiveness.

Our financial markets keep our economy going, we need them open and strong.

- In 2010, Congress passed the Dodd-Frank Act to strengthen U.S. banks and safeguard the financial system. The law led to a set of new rules that require the largest U.S. banks to dramatically increase the amount of “capital,” which includes equity and debt securities, held to protect against difficult times. Since 2010, the amount of capital the largest U.S. banks have on hand has more than tripled, making U.S. requirements among the highest in the world.

- In addition, the rules require that the largest banks go through stringent “stress tests” each year to ensure each bank can handle economic shocks and continue to support the economy.

- Banks support the economy by helping individuals, companies, and institutions access financial markets to get the funding they need to pursue their goals. The U.S. capital markets are the deepest and strongest in the world – funding moves smoothly through the pipes to reach every part of the economy that needs investment. We lead the world in innovation because our financial markets make financing available to fund good ideas and ambitious entrepreneurs. We recover faster from economic downturns because financing moves quickly to where it can best restore growth. The European Union (EU), for example, has a public policy objective to develop their capital markets to be more like the U.S.

Consumers will feel the costs of the proposal.

Businesses ranging from farms, manufacturers, and small businesses to airlines and energy companies work with banks to access financial markets to finance investment and to lock in the cost of supplies and other business needs so they can keep prices lower for customers.

- Farmers turn to banks to help them lock in the price of fertilizer so they can better run their farms.

- Manufacturers turn to banks to lock in transportation costs so they can deliver better value for customers.

- Pension funds turn to banks to assist in growing retirement and pension funds for savers.

- Small businesses turn to banks for credit needs to grow their businesses.

- Municipalities turn to banks to help them obtain funding for infrastructure, education, parks, and other state-wide projects.

- Energy companies turn to banks for critical financing of clean energy projects and, in-turn, lower energy costs to consumers.

- Airlines turn to banks to help them lock in fuel costs so they can keep ticket prices more stable.

Domestic Labor Shortage

The COVID-19 pandemic exacerbated labor shortages across the economy.

- Many workers did not return to the workforce after the COVID-19 pandemic for a variety of reasons, including early retirements, difficulty arranging child care, and concerns for their health.

- A shortage occurs when the number of job openings is greater than the number of workers filling them. As of August 2023, there were 8.8 million openings compared to 6.3 million unemployed workers.

- The COVID-19 pandemic accelerated this trend, but the issue was always on the horizon. Workers are retiring faster than new workers are joining the workforce. This creates an unsustainable trend where essential services do not have the labor to successfully serve society.

- Recent bipartisan legislation such as the CHIPS and Science Act and the Bipartisan Infrastructure Law provided funding for infrastructure investment, but a shortage of skilled labor will delay the timeline and implementation of these projects.

Labor shortages are affecting almost every industry, passing costs to consumers.

- About 1.4 million manufacturing jobs were lost during the COVID-19 pandemic.

- The construction sector is hit one of the hardest, and the costs are pretty wide-ranging, making it more expensive to build literally anything.

- The labor shortage leads to fewer contributions for Social Security, affecting retirement plans for many Americans.

- Less workers on farms create increased food prices.

- Completion of construction projects, whether they are residential homes, infrastructure initiatives, or hospitals, is restricted by a lack of available labor.

- Shortages of public transportation employees affect anyone who commutes to work, school, to run errands, get to appointments, etc.

- Without the necessary amount of workers, healthcare systems will have an increasingly difficult time providing care to those who need it most.

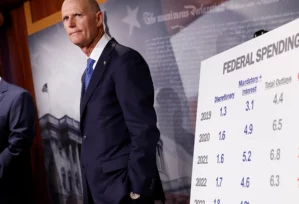

The National Debt

The U.S. has always had to deal with budgeting to avoid debt.

- Every year, the federal government earns and spends vast amounts of money. If the government spends more than it brings in, that creates a deficit. If the government operates in a deficit for years at a time, the deficits accumulate to form debt.

- The United States has carried debt since its creation, when the Founding Fathers funded the American Revolutionary War. Large increases in the debt occurred during wars, recessions, and pandemics.

- Increased spending provides for programs such as Social Security, Medicare and Medicaid, unemployment and disability benefits, and the national defense.

- Like any other type of debt, the national debt gathers interest, and as the debt grows, so does the amount of interest.

The national debt is an abstract concept that affects every American.

- Current and future generations will have to manage the debt.

- The national debt is over $33.55 trillion dollars, which is over $100,000 of debt per American.

- High deficits and debt can lead to persistent high inflation, raising costs on everyday goods and services.

- Rising interest rates affect the ability of hard working Americans to get loans or take out mortgages.

- As the interest on the debt rises, the government may have to make choices about which programs to fund, potentially reducing Social Security payments and other benefits.

- Taxes could increase to raise revenue and offset spending.

- Increased government borrowing could crowd out other types of investments in small businesses, infrastructure, and manufacturing.

What is the Fed Proposal?

Financial institutions and markets are regulated by several agencies in Washington to make sure they are safe and sound. That regulation was increased dramatically after the 2008 financial crisis, so that banks and financial markets were able to help support the economy during turmoil.

The Federal Reserve proposed new capital rules that could increase capital requirements (how much money a bank holds in reserve) on the nation’s largest banks. Because banks will have to hold more assets on hand that cannot be loaned out, the availability of credit across our economy will shrink – reducing lending to individuals and small businesses, raising the costs of running a business or investing in a community, and reducing returns on retirement savings.

The U.S. financial markets are the deepest and strongest in the world, and individuals, companies and local governments rely on them to finance the investments that make our lives better. This proposal would make financing more expensive, which ultimately raises costs on everything from everyday goods and bills to airline tickets to food to energy bills.

Hear from Policymakers and Stakeholders

Bipartisan concerns with the Fed capital proposal “Basel III Endgame” have ranged from:

- Housing affordability. As housing affordability issues continue to plague Americans across the country, there was bipartisan concern that the proposal could further reduce mortgage lending, especially for low-and moderate-income households making the American dream of owning a home even more unattainable.

- Renewable energy. There was bicameral policymaker concern that as the country looks to build out its clean energy manufacturing and technology sector, the proposal, coupled with record high interest rates could increase the cost of using renewable energy and drastically hurt the growth of the nascent industry.

- Impacts to small businesses. There was bipartisan and bicameral concern on the proposal’s impacts to small businesses seeking credit and access to capital. This is particularly important as small businesses are a central component of today’s economy and labor market.

- Economic recovery. More broadly speaking, there was overarching concern across both committee’s membership with the unintended consequences of the proposal on the economy and whether it will impact the ongoing recovery efforts.

Resources

Nearly every industry will face increased costs that will be passed on to Americans, resulting in things like:

Higher electricity bills for heating and home energy

Higher airline ticket prices

Higher airline ticket prices

Higher insurance premiums

Higher costs and reduced returns on American savers’ 401ks and pensions

Higher costs for manufacturing everything, from semiconductors to steel

Higher interest rates for loans for small businesses

Higher interest rates for loans for small businesses

Why is there a labor shortage?

A labor shortage is a critical issue that has had far-reaching effects on everyday Americans, magnified by the challenges brought about by the COVID-19 pandemic, which led to widespread layoffs in some sectors while also causing a reevaluation of work-life priorities for many individuals. The pandemic had a significant impact, but the problem was looming even before.

The U.S. was already on the precipice of a labor shortage due to a combination of factors. An aging population is gradually retiring, removing labor from the workforce without the amount of new talent to replace them. Furthermore, the skills required in today’s job market are evolving rapidly, and some workers may not possess the necessary qualifications, leading to a mismatch between available jobs and the workforce. In the next decade, it is possible industries will not have enough workers to meet the demand for their services.

The industries hit the hardest include manufacturing, leisure and hospitality industries, and food service. Shortages have broad implications; they lead to reduced contributions to Social Security, impacting retirement plans, and raise the prices of goods and services as industries struggle to find workers.

Additional Labor Shortage Resources

What makes up the national debt?

The national debt is a financial burden that holds significant implications for everyday Americans. Each year, the federal government earns and spends substantial amounts of money, and when expenditures exceed revenues, a deficit is created. Over time, these deficits accumulate to form the national debt. There are two major categories of federal debt: debt held by the public and intragovernmental holdings. Debt held by the public is any debt not attributed to the federal government. This means debt held by individuals, businesses, and state and local governments is considered to be held by the public. Intragovernmental debt is the debt the federal government and its agencies hold.

Increased spending provides for programs such as Social Security, Medicare and Medicaid, unemployment and disability benefits, and the national defense. When the government borrows money to support these programs, that debt gets added to the national debt. As the debt continues to grow, so does the amount of interest the government must pay.

Government spending helps support many Americans, but budget deficits have resulted in a national debt affecting all corners of the economy. Managing the national debt is a task that transcends generations, requiring pragmatic fiscal policy to safeguard the financial well-being of the American people.